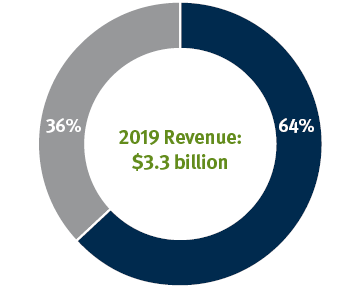

Stifel | A Premier Financial Services Firm

A financial services provider with extensive ties to private investors and middle-market companies and institutions across the U.S.

Stifel brings deep expertise to providing diverse financial services to an array of clients, including individuals, public and private businesses, municipalities, and institutional and professional money managers. Our people make the difference, as our financial professionals respect the importance of relationships built on trust and value delivered.

|

|

|

Our financial ratios are strong, positioning us well for the future. We have:

- A stable and growing balance sheet with $3.6 billion in shareholders' equity

- A low leverage ratio of 6.8x

- Equity capital ratios well in excess of regulatory requirements

Defying the industry trend of bank-owned investment firms, Stifel instead acquired a bank in 2007, expressly to support the needs of private clients. As of June 30, 2020, assets at Stifel's banks were $18 billion.

Stifel's public finance practice helps improve communities across the country. We are a leader in:

- Underwriting bonds for K-12 public school systems across the U.S.

- Financing housing projects that serve low- and moderate-income families

- Assisting state and local government entities in raising capital to improve infrastructure and other projects

- Working with institutions of higher education of all sizes around the country

Figures are as of December 31, 2019, unless otherwise stated.

1 EquityCompass Investment Management, LLC and Washington Crossing Advisors, LLC are wholly owned subsidiaries and affiliated SEC Registered Investment Advisers of Stifel Financial Corp. (“Stifel”). 1919 Investment Counsel is an SEC Registered Investment Adviser and indirect subsidiary of Stifel.

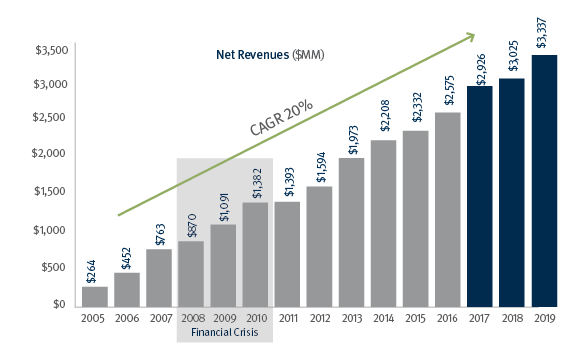

Stifel has shown enviable ability to grow its business - through boom and bust cycles

|

Stifel's strategy hasn't changed since 1997 -

To be the Choice for all of our key stakeholders: Clients, Associates, and Investors

| Investment of Choice For small and large shareholders, our commitment is to create value and maximize return on investment. |

|

| Advisor of Choice For individual, institutional, corporate, and municipal clients who expect us to listen and consistently deliver innovative financial strategies. |

|

| Firm of Choice For hard-working team players who devote their energy and attention to client needs. |

Stifel | Global Wealth Management

Broad capabilities for those with sophisticated and complex needs.

Understanding Your Wealth |

Organizing Your Wealth |

Understanding Your Risk Tolerance |

Understanding Your Financial ID |

Investing Your Wealth |

Monitoring and Adjusting Your Plan |

... And is supported by the robust capabilities we need to support our clients' needs.

Trust & Estate Planning |

Investment Management |

Lending |

Bank & Trust Services |

Investment Products |

Capital Markets |

Investment Banking |

|

Stifel does not offer legal or tax advice. You should consult with your legal and tax advisors regarding your particular situation.

Lending services for clients of Stifel, Nicolaus & Company, Incorporated are performed exclusively by Stifel Bank and Stifel Bank & Trust (Stifel Banks). Stifel Bank, Member FDIC, Equal Housing Lender, NMLS# 451163, is affiliated with Stifel Bank & Trust, Member FDIC, Equal Housing Lender, NMLS# 375103, and Stifel, Nicolaus & Company, Incorporated, Member SIPC & NYSE, each a wholly owned subsidiary of Stifel Financial Corp. Unless otherwise specified, references to Stifel may mean Stifel Financial Corp. and/or any of its subsidiaries. Unless otherwise specified, products purchased from or held by Stifel are not insured by the FDIC, are not deposits or other obligations of Stifel Banks, are not guaranteed by Stifel Banks, and are subject to investment risk, including possible loss of the principal.

Trust and fiduciary services are provided by Stifel Trust Company, N.A. and Stifel Trust Company Delaware, N.A. (Stifel Trust Companies), wholly owned subsidiaries of Stifel Financial Corp. and affiliates of Stifel, Nicolaus & Company, Incorporated, Member SIPC & NYSE. Unless otherwise specified, products purchased from or held by Stifel Trust Companies are not insured by the FDIC or any other government agency, are not deposits or other obligations of Stifel Trust Companies, are not guaranteed by Stifel Trust Companies, and are subject to investment risks, including possible loss of the principal invested. Stifel Trust Companies do not provide legal or tax advice.

| “What should I do to prepare for selling my business?” | “Where are today's dislocations creating excess return potential?” | “I'm hungry for income, but not duration risk.” |

| “How can I monetize my significant company stock holdings?” | Wealth Management Tailored for You |

“With so much uncertainty, what risk mitigation strategies make sense for me?” |

| “Can I use leverage to capture emerging opportunities?” | “What's my optimal use of personal, retirement, and trust accounts?” | “I want to transfer wealth to my children without compromising my personal goals.” |

Stifel | Investment Bank

A premier resource for middle-market companies.

We are a full-service investment bank, managing public offerings of equity and debt securities, raising debt and equity in the private market, and initiating, structuring, and negotiating mergers, acquisitions, and divestitures.

| Our Industry Groups | ||

|

|

|

We are a leader in the middle market since 2010:

No. 1 in Total Number of Managed Equity Deals Under $1 Billion1 |

Mid-Market Equity House of the Year

Thomson Reuters' International Financing Review

|

|

|

Source: Dealogic. Includes firms acquired by Stifel. As of December 31, 2019.

1 Rank-eligible SEC-registered IPOs and follow-on offerings since 2010

2 Excludes closed-end funds and trust preferreds

3 A Analytics